For decades, private markets were dominated by large institutional investors such as pension plans, sovereign wealth funds, endowments, and insurance companies. While this is still largely true, through registered investment advisors and other wealth management platforms, individuals are playing an increasingly important role as capital providers in the industry.

Individuals invest in private assets in a variety of ways: through taxable accounts, self-directed retirement accounts, trusts, as well as personal foundations they have set up for philanthropic purposes. As individual investors become more familiar with private markets, a natural question arises: “How much should they allocate to illiquid private assets?”

In this article, we start by looking at self-directed IRAs, which are where many investors place the alternative assets they purchase. We start there because asset location is an important factor in determining private asset allocation. We then broaden the discussion to a framework on how much one should allocate to alternative assets across their portfolio. While we do not think there is one right answer, our framework helps individuals consider the primary factors.

Alternative Assets Within Self-Directed IRAs

Individual Retirement Accounts (IRAs) were authorized in the U.S. in 1974 as part of the Employment Retirement Income Security Act of 1974 (ERISA). Since IRAs are investment accounts intended to provide income during retirement, they tend to have a long-term outlook regarding investment returns and cash needs. Many IRA custodians typically only accept highly liquid equity, fixed income, and money market securities. However, by working with specialized custodians, investors can establish self-directed IRAs which can hold a much wider range of assets, including commodities, private equity, real estate, and other illiquid assets.

Despite there being a wider range of assets that can be typically held in self-directed IRAs, the same considerations of deferring, or eliminating, taxes on ordinary income and capital gains applies. As such, taxable fixed-income investments such as private debt funds may be well-suited for the IRA since the ordinary income it generates can be reinvested on a pre-tax basis. Decisions about asset location for private debt and other asset types, however, are heavily dependent on an individual’s age, expected holding periods, expected future tax rates, the nature of income earned (for example whether it is treated as unrelated business taxable income (UBTI), or not, and other considerations. Investors should consult their tax advisors before making investment decisions.

In addition to determining which types of assets are most appropriate to be invested in an IRA, managing the cash flow of private assets in an IRA needs to be considered. Investors are not permitted to transfer funds from a taxable account (beyond the annual limitation) into a tax-deferred account, or to borrow in a tax-deferred account, without incurring substantial tax penalties. These limitations constrain investors by requiring them to have ample cash or marketable securities in their IRAs to meet capital calls for closed-end funds, meet unexpected expenses for real estate, or have sufficient liquidity once they (or their heirs) start to take required minimum distributions.

Since asset allocation within tax-advantaged accounts such as IRAs needs to be assessed within the broader context of an investor’s entire portfolio, we next widen the lens to look at some of the most important factors investors should consider.

Assessing Risk Tolerance

Alternative assets are often considered riskier than traditional assets, which is why they provide the potential for higher returns. In general, however, that is not necessarily true. For example, large-cap private equity may offer higher potential returns than large-cap public equity, but those returns may be due to less liquidity, or more difficulty accessing private equity opportunities, rather than the greater investment risk. But, if an investor compares venture capital private equity to large-cap public equity, there is undoubtedly more risk with the venture capital asset in addition to less liquidity and less access. An investor’s overall risk appetite will guide their selection of private assets much the way it guides their selection of public securities.

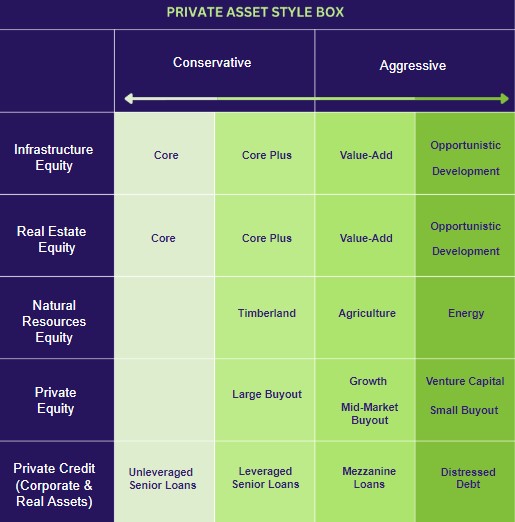

As an indicative guide, we have created a “style box” to help individual investors align specific private asset strategies with their overall risk tolerance. Please note, however, that the style box is for funds, not individual securities, so unless an investor holds a large portfolio of individual securities, the risk they are taking by owning one or a small handful of securities is more aggressive than presented. Please also note that, like public securities, private assets in emerging markets are generally considered riskier than those in developed countries.

Importance of Maintaining Diversification

If an investor aligns their private asset holdings with their overall investment risk tolerance, they could theoretically allocate a substantial portion of their portfolio to private assets to benefit from higher expected returns. However, since private markets are appreciably smaller than public markets (for example, private equity is about 10% the size of public equity markets), investors will still want a large portion of their portfolio in public markets for diversification purposes and access to companies or assets that you cannot find in private markets.

Take, for example, the Magnificent 7 stocks (MSFT, AAPL, NVDA, GOOG, AMZN, META, and TSLA) – their combined market capitalization of about $14 T as of May 6, 2024, exceeds the size of the entire private equity market, and those stocks rose by about 28% per annum for the last five years. As we will show later, even the largest institutional investors with limited liquidity constraints hold 50% or more of their investment portfolios in public securities.

Lifestyle

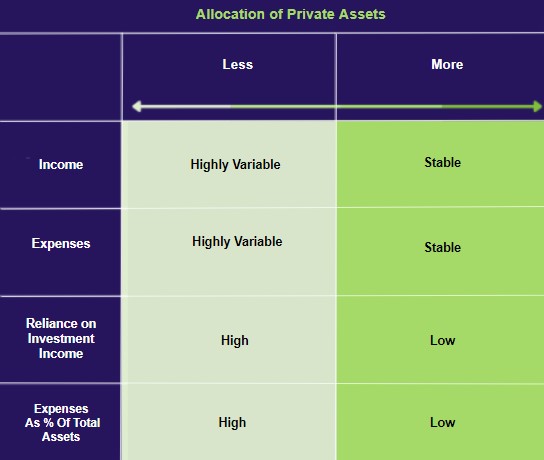

We discussed above how liquidity needs can limit the amount an investor may allocate to IRAs. Those same liquidity needs also apply to an investor’s broader taxable portfolio. Most successful people operate on a personal budget. This can be thrown into disarray in the event of an unexpected life/work change – a job loss, a family health issue, or a business owner going through a slow patch. We think deciding how much to allocate to illiquid private assets can depend significantly on how stable their income and expenses are and how much they are relying on their investment portfolio to support their current lifestyle. Directionally, i) the more stable an individual’s income and expenses are, ii) the less dependent an individual is on investment income to maintain their existing lifestyle, and iii) the lower the percentage of expenses to total wealth, the more the individual can allocate to private assets.

How Much Do Institutional Investors Allocate to Private Assets?

We discussed several factors that we think should be considered when deciding how much of one’s investable assets to allocate to private assets, including risk tolerance, diversification, and lifestyle. Trying to build a model that provides a specific answer to our question of how much institutional investors allocate to private assets would be too complex due to all the factors involved and elements of personal judgment. However, looking at how institutions make their allocation decisions can be a useful guide for individuals. Below, we’ll look at several different types of institutions: endowments, large family offices, public pension plans, corporate pension plans, and property & casualty insurance companies.

Endowments

With their long investment time horizons, large U.S. endowments have been leaders in allocating a greater percentage of their portfolios to private assets and may be a guide to how some individual investors, particularly high-networth individuals may want to think about their own portfolios. In its 2022 Annual Review of Endowments, Cambridge Associates calculated that the 316 endowments it tracked allocated about 29.5% of its portfolios to private assets. The 61 largest endowments in its review, with assets greater than $3 billion, allocated about 43.8%. And, separately, Yale University, which has been a leader among endowments, had over 50% of its portfolio in private assets as of 2020. This allocation makes sense because, in addition to their long-time horizons, universities are often characterized by a high degree of stability of income and expenses.

Property & Casualty Insurance Companies

Conversely, property casualty insurance companies are risk-bearing entities. They take in premiums which are priced based on the probability of certain events happening – a tornado, a house fire, a car accident, etc. – and invest the capital hoping that the return on that capital exceeds any losses from negative events that require them to pay out capital to the insured. This is a comparatively more volatile model than the endowment example above as the probability of an unpredictably extreme event that will impact liquidity is always lurking. Consequently, their allocation to alternative investments is typically lower than our large endowment example above. According to the National Association of Insurance Commissioners, property casualty insurance companies allocated 8.7% of their portfolios in 2021, respectively.

If you think about university endowments and property & casualty insurance companies as bookends on the scale of institutions making allocations to private assets, large family offices, public pension plans, and corporate pension plans mostly fit between the two.

- According to the UBS 2023 Global Family Office Report, the average large family office (average $2.2 billion of assets) has approximately 45% of its assets in alternatives.

- According to the National Association of State Retirement Administrators, the average public pension fund has approximately 29.4% of its assets in alternatives (including real estate).

- According to an analysis by WTW (formerly Willis Towers Watson), the average Fortune 1,000 corporate pension plan has approximately 11.1% of its assets in alternatives.

Applying the Institutional Model to Individual Families

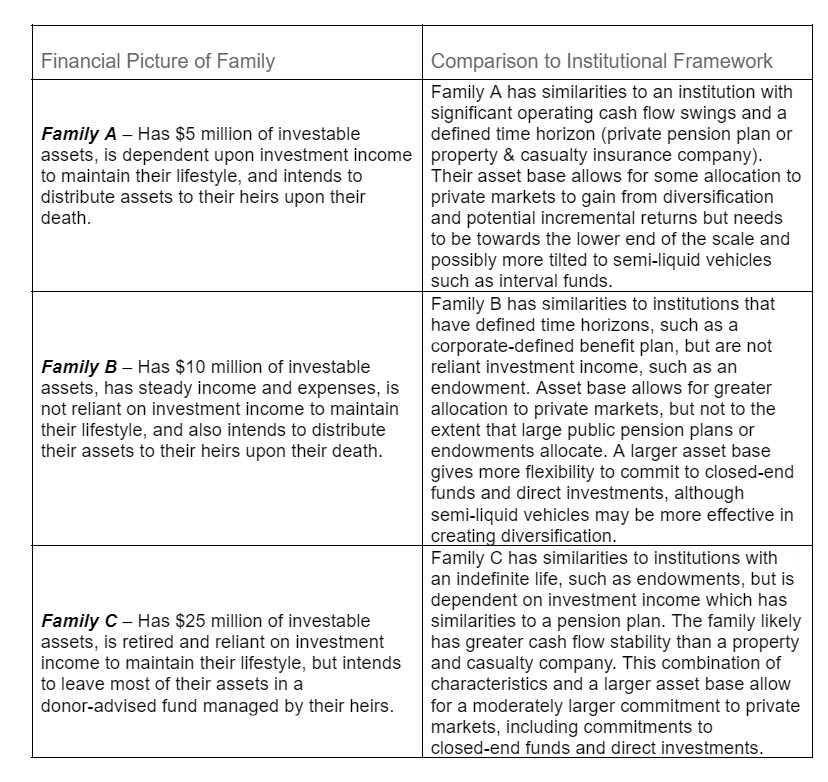

The way institutions think about their private market allocations can provide a framework for individuals and their families, so we ask the question, “What type of institution does the family look like?” A few examples might help to explain this:

From the Impersonal to the Personal

Looking at how large institutions decide how much of their portfolios to allocate to private markets seems cold and impersonal to a family making personal decisions about how to invest their wealth. But while most of us really enjoy talking about specific stocks or an exciting new real estate opportunity, asset location and asset allocation decisions can be where investors reap substantial rewards. We think there are a few important things to consider when deciding whether to invest in private markets, how much, and where:

- Private assets offer the potential for higher returns and greater diversification, but the total market size is a small fraction of all investable assets. Maintaining a broadly diversified portfolio requires having a meaningful allocation to public market securities regardless of the amount of wealth a family has.

- Private assets are not a separate asset class but generally fall into the traditional equity and fixed-income buckets we are all familiar with. Understanding the investment strategy of a private fund manager is important to position a fund in a “style box” as we presented above and within a broader allocation framework.

One way to think about this is that almost all buyout funds invest in companies that would be considered mid-cap or smaller (less than $25 billion market capitalization). Private equity buyouts, then, are an alternative to public market mid- and small-cap equities, and not their own asset category.

- Illiquidity of private assets becomes an important aspect of deciding i) where to invest (asset location) as we described above for tax-advantaged accounts such as self-directed IRAs, and ii) how much to allocate.

When making their overall private asset allocation, individual investors and their families need to carefully consider how stable or variable their income and expenses are, how dependent they are on investment income to maintain their lifestyle, and whether they expect their assets to be dispersed among their heirs or charities upon their death or maintained in a foundation or donor-advised fund.

Explore the Depths of Private Markets

As investors, advisers, and fund managers look to “democratize private markets,” a greater understanding of all the complexities of the market is needed. While institutional investors have substantial experience investing in private markets and many resources to draw upon, even the most sophisticated institutions are continuing to learn about new products and strategies and adapt to regulatory and technological changes. Individual investors should consider taking the same approach by diving deeper into different aspects of the market, such as asset allocation.

For investors looking to learn more about asset allocation and private markets, we recommend David Swensen’s classic book Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment. Swensen was the Chief Investment Officer of Yale University from 1985–2021 and oversaw its growth from about $1 billion to over $40 billion. Also, a good recent research report that specifically looks at investment trends at large family offices is Goldman Sachs’ Eyes on the Horizon.

Important Notice: Private Markets Navigator does not provide investment advice, and the information should not be construed as such. Investing in private asset funds is risky, with potential for total loss and long-term liquidity restrictions. Read our full dislaimer.