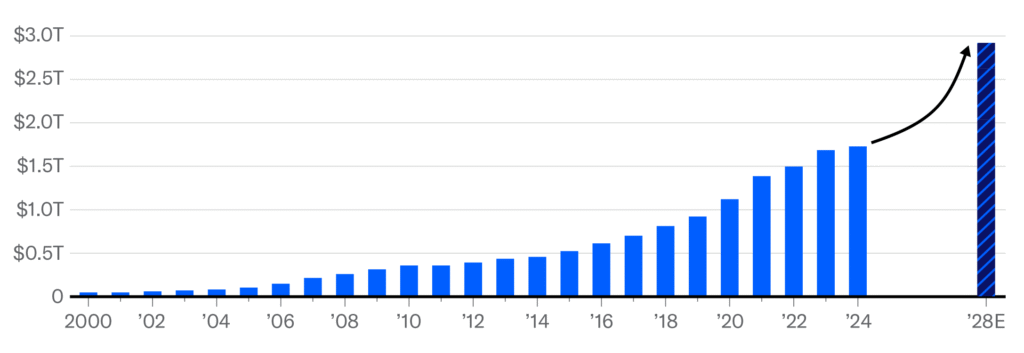

In a report issued last week, Moody’s detailed how private credit is being used to fill global demand for capital and is expected to reach almost $3 trillion by 2028. However, they also point out that private credit is becoming more complex and attracting individual investors, partly due to regulators allowing for broader access to private markets.

Global Private Credit AUM

Moody’s believes that credit risk is growing. They highlighted market risks, such as the increasing concentration of private fund managers and expansion into areas such as asset-backed finance. They also mentioned risks to investors, such as greater use of pay-in-kind features, the securitization of newer or riskier asset types, and structuring to create investment-grade tranches. Moody’s points out that these risks need to be weighed against the benefits of greater diversification for investors.

The growing complexity of private credit requires a cautious approach for investors, especially individual investors. They must educate themselves about the broad use of private credit, structures, and features that managers use to support economic growth. Many of the private credit elements that Moody’s discusses have not been tested at scale in a recessionary environment.

Steve was formerly the Chief Investment Officer and Head of Private Markets at Manulife Investment Management. In this role, he was responsible for leading global investment teams across a wide range of asset classes, including private equity and credit, real estate, infrastructure, timber, and agriculture. Steve has served as a director of many public and private companies during his career, including two of Manulife’s U.S. SEC-registered investment advisors.

Important Notice: Private Markets Navigator does not provide investment advice, and the information should not be construed as such. Investing in private asset funds is risky, with potential for total loss and long-term liquidity restrictions. Read our full dislaimer.