After a lively discussion at its September 2025 meeting, the SEC’s Investor Advisory Committee approved recommendations for retail access to private market assets. The Committee stated that “the optimal way for retail investors to access private market assets is through registered funds” and voted on several measures to improve access to those funds. It also recommended greater disclosures related to valuations and liquidity for registered funds.

Although the Committee did not take a position on whether to expand direct access to private assets, it adopted proposals to refine the definition of an “accredited investor” and limit how much non-accredited investors can invest directly in private assets. Recognizing the importance of greater transparency for exempt (non-registered) offerings, the panel also recommended that issuers be required to provide investors with basic information about those offerings. Despite the good intentions behind these recommendations, it remains unclear whether they will offer meaningful protection to retail investors.

Enhanced Disclosures

In its review of registered funds, the advisory panel assessed the risks of valuing private assets and recommended that funds disclose more about how they determine values and when they override or reject independent appraisals. The panel also urged stronger disclosures regarding liquidity provisions and illiquidity risks so investors can make informed decisions.

For non-registered offerings, the panel presented a list of baseline disclosures it views as a starting point. Among the most significant items were the disclosure of i) prior bad acts (e.g., fraud) and ii) “material risks and conflicts of interest.”

Access Based on Investor Sophistication

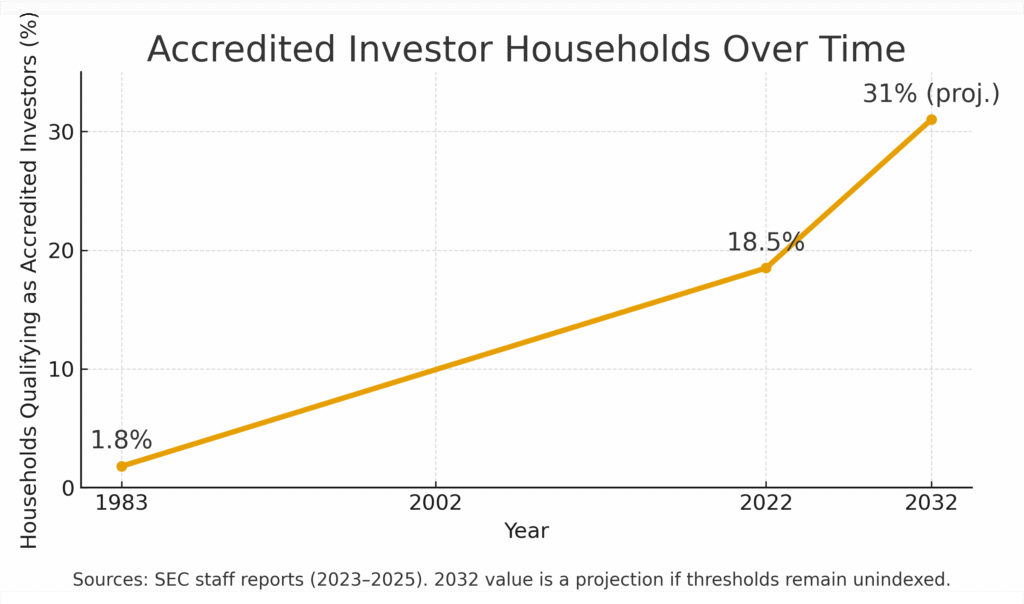

A substantial portion of the advisory committee’s report focused on who should have direct access to private assets and how much they can invest. Much of this discussion centered on defining an “accredited investor,” a category that today includes nearly 20% of U.S. households (up from about 2% in 1983). Since its inception in 1982, the definition has covered individuals earning more than $200,000 annually (or couples earning over $300,000) or households with a net worth exceeding $1 million.

The committee recommended placing less emphasis on these financial thresholds and more on demonstrating sufficient knowledge of private asset risks through a professional certification or an accredited investor test. If direct access to private assets expands beyond accredited investors, the committee further recommended limiting the amount individuals or households could invest based on income and wealth measures.

From Disclosure to Understanding

The Committee’s recommendations aim to balance broader access to private markets with stronger investment protection through enhanced disclosure. However, disclosure alone has well-known limitations. Research consistently shows that increased disclosure often fails to protect investors when dealing with complex financial products such as private market assets.

In June 2024, the Investor Advisory Committee recommended that financial services firms provide more access to investor education. The report recommended “that the SEC require regulated firms to provide access to conflict-free investor education materials in real time, when and where investors need credible, reliable information.” Yet, there has been little movement toward implementing this recommendation, which could help individual investors better understand disclosures.

Given the complexities of private market products – liquidity, fees, and valuations among them – investor education on the fundamentals of private market investments and how they fit within an overall portfolio would offer far greater protection to retail investors. To adapt a quote from Franklin Roosevelt, the real safeguard of democratization is education.

Steve was formerly the Chief Investment Officer and Head of Private Markets at Manulife Investment Management. In this role, he was responsible for leading global investment teams across a wide range of asset classes, including private equity and credit, real estate, infrastructure, timber, and agriculture. Steve has served as a director of many public and private companies during his career, including two of Manulife’s U.S. SEC-registered investment advisors.

Important Notice: Private Markets Navigator does not provide investment advice, and the information should not be construed as such. Investing in private asset funds is risky, with potential for total loss and long-term liquidity restrictions. Read our full dislaimer.